geothermal tax credit new york

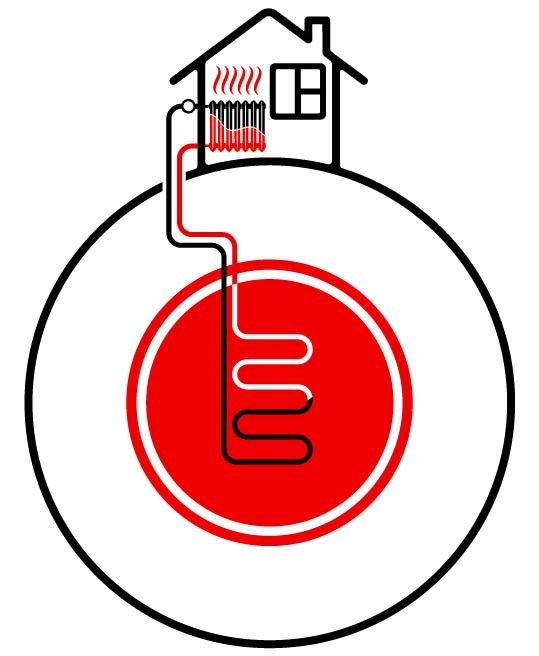

COP Coefficient Of Performance - of a heat pump is the ratio of the change in heat at the output the water reservoir of interest to the supplied work. Theres no limit on its value.

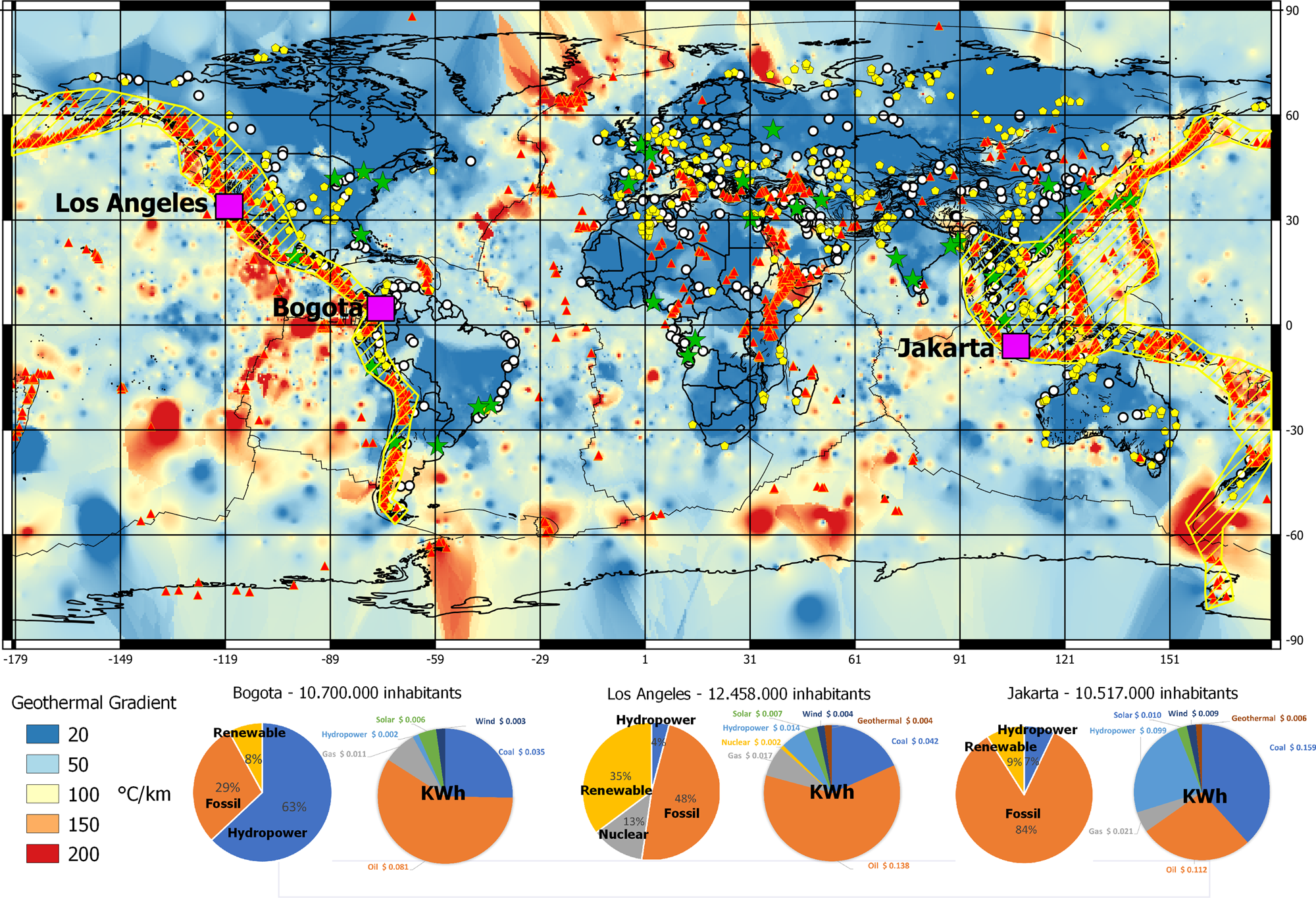

Geothermal Energy As A Means To Decarbonize The Energy Mix Of Megacities Communications Earth Environment

Using a geothermal heat pump is a climate-friendly energy-efficient option available to heat and cool your home and this tax credit will make transitioning to them more.

. The Geothermal Tax Credit filed through form 5695 covers expenses associated with the installation of ground source heat pumps. Additionally homeowners are eligible for New York States Clean Heat Program which. A 30 federal tax credit for residential ground source heat pump installations has been extended through December 31 2032.

EER Energy Efficient Ratio - The higher the EER rating the more energy efficient the equipment is. New York State offers a 25 tax credit on geothermal installation expenses up to 5000. The New York Geothermal Energy Organization is a non-profit organization representing ground source heat pump GSHP installers manufacturers distributors general contractors.

New York Geothermals best-in-class technology systems meet and surpass New Yorks imminent requirements for energy efficiency far outperforming other solar and wind solutions. Combined with the current 26 federal tax credit for geothermal systems state incentives now give residents in most parts of New York an average of 50 reduction in what the usual costs of geothermal would be. Taxpayers could get a tax credit equal to 25 on geothermal energy system expenditures up to 5000 according to a budget bill introduced by the Assembly.

Utility Incentives On average a 2500 square foot home that installs a 5 Ton 47900 BTUH Heat Pump. June 12 2015. As a credit you take the amount directly off your tax payment rather than as a deduction from.

Federal Income Tax Credit 25 New York State Tax Credit New York State Real Property Tax. AN INDIVIDUAL TAXPAYER SHALL BE ALLOWED A CREDIT AGAINST THE TAX IMPOSED BY THIS ARTI- CLE EQUAL TO TWENTY-FIVE PERCENT OF QUALIFIED GEOTHERMAL ENERGY SYSTEM. We also encourage you to consult an accountant or tax advisor if you have any questions.

Whether your goal is creating a new net zero energy building or upgrading an older structure we can help you achieve unprecedented energy independence. This includes labor onsite preparation equipment. The federal tax credit initially allowed homeowners to claim 30 percent of the amount they spent on purchasing and installing a geothermal heat pump system from their federal income taxes.

The credit is equal to one cent for each percent of biodiesel per gallon of bioheating fuel purchased before January 1 2023. Tax credits includes installation costs. Geothermal makes sense in any statewhy are more homeowners in new york switching to geo30 federal tax credits 1000 per system local rebate and a payback or return on.

New York offers state solar tax credits capped at 5000. The measure will make homeowners eligible for a 25 tax credit of up to 5000 for the installation of geothermal systems as New York seeks to transition to renewable and. As of 2022 the Geothermal Federal Tax Cred it allows you to deduct 26 of the cost of installing a geothermal heating and cooling system from your federal taxes.

It may not exceed 20 cents per gallon. New York State Energy Tax Credits. New York State offers a 25 tax credit on geothermal installation expenses up to 5000.

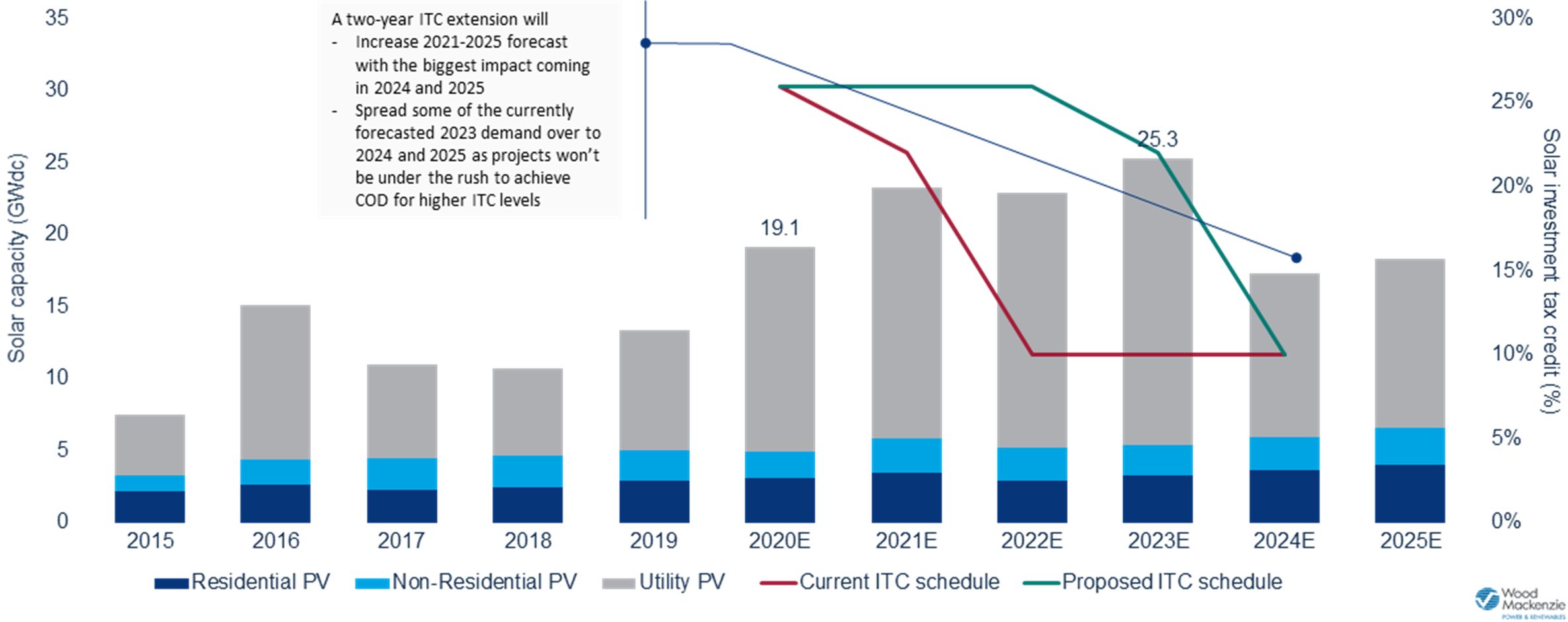

New York State offers several New York City income tax credits that can reduce the amount of New York City income tax you owe. The incentive will be lowered to 26 for systems that are installed. New Yorkers have more reason than ever to move towards air and ground source heat pumps.

The credit is only allowed for. That incentive is set to go down to 22 in 2023 before being sunset altogether in 2024. This bill allows for a 25 state income tax.

Dandelion Energy the nations leading home geothermal company celebrates the passing of the New York state budget which includes a new tax credit for residential. The Ne w York State Assembly and Senate have passed the Geothermal Tax Credit bill A2177A A2177A-2015. The tax credit currently stands at 26 percent throughout 2021 and 2022 before decreasing to 22 percent in 2023.

How The Federal Geothermal Tax Credit Works

A Geothermal Energy System In Your House Burgeoning Installer Dandelion Expands Its Territory In Ct

Geothermal Tax Breaks And The Google Startup Bringing Earth S Heat Into Homes Inside Climate News

Just In From Ny Geo Green Energy Times

Home Geothermal Systems Earn New York Tax Credit

Geothermal Energy Use Getting Boost From New York State Tax Credit The Well News Pragmatic Governance Fiscally Responsible News Analysis

Just In From Ny Geo Green Energy Times

New York Geothermal Energy Organization Home Facebook

Is It An Option For Your Association Geothermal Heating And Cooling Cooperatornews New York The Co Op Condo Monthly

The Federal Geothermal Tax Credit Your Questions Answered

Converting To Geothermal Energy The New York Times

Geothermal State Federal Tax Credits Dandelion Energy

Heating Incentives Financing Smart Energy Choices

Geothermal Industry Wins Tax Credit Extension In Stimulus Bill 2020 12 31 Achr News

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac

New York Homeowners Could Qualify For Geothermal Tax Credit